Teardown | Udaan - India's leading B2B Marketplace

Founded in 2016, Udaan grew to become one of the fastest unicorns in India.

We publish research on the latest shifts across the eCommerce industry and highlight the companies transforming it. Sign up below to get the latest in your inbox.

These briefs are produced by leveraging publicly available data sources and information. If you notice a mistake or see an area for improvement, please let us know ugh this typeform.

Snapshot

Founded in 2016, Bangalore headquartered Udaan is a B2B marketplace connecting manufacturers, wholesalers, retailers, and traders.

The company provides a range of solutions across technology, logistics, and financial services to facilitate transactions.

Udaan is currently one of India’s largest B2B platforms, catering to diverse categories consisting of pharmaceuticals, electronics, lifestyle, and many other general categories.

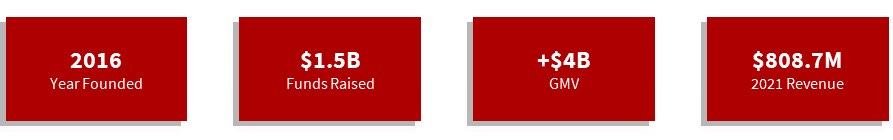

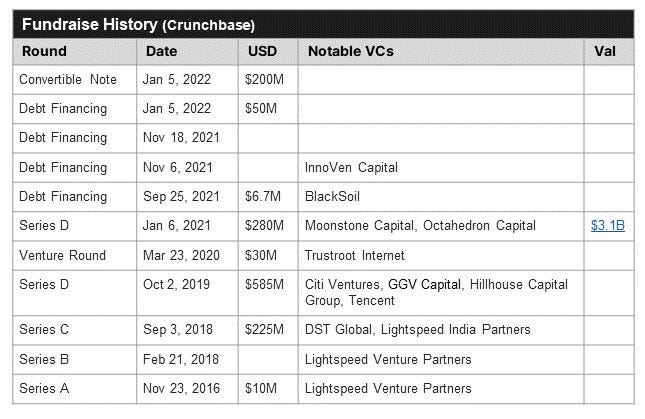

The company has raised $1.5B in multiple funding rounds. The company’s last disclosed valuation was $3.1B when it raised a Series D in Jan 2021. It has subsequently raised further funding at undisclosed valuations.

Business Overview and Products

Udaan’s core offering is its B2B marketplace, which is a one-stop solution for conducting transactions. The platform provides access to all members of a supply chain, from manufacturers to end-user retailers, to transact across an expansive range of high-quality, competitively-priced products. The company boasts over 500,000 products across a range of verticals such as electronics, FMCG, pharmaceuticals, and more.

Udaan also provides a slew of other services such as a product delivery service called udaanExpress, and udaanCapital, which provides trade financing to users of Udaan’s B2B platform. Through the use of finance, technology, and logistics, the company aims to mainly empower smaller traders to compete with larger corporates in the retail world.

How It Works

Retailers on Udaan’s platform can browse through various categories of products and place orders for their desired needs. The seller – generally a manufacturer or wholesaler – books the order, packs it, and gets it ready for delivery. Udaan’s logistics team then assists the seller with the pick-up and delivery of the shipment. Once the shipment is delivered to the retailer, payment is collected and settled into the seller's account on Udaan.

By directly connecting manufacturers with retailers, Udaan allows business buyers to bypass intermediaries and get products more affordably. The company operates over 200 warehouses totaling 10 million square feet to facilitate logistics.

Udaan’s users can connect with other parties via its online platform or a mobile application. Udaan also currently owns an NBFC (non-banking financial company) license to provide financing in the form of loans to small retailers, which saves them from the high-interest rates charged by local lenders.

Business Model and Pricing

Udaan earns revenue through several streams. The company charges a commission on all transactions which is been reported to be in the range of 15-18%. The company also generates revenue through several additional streams including:

Warehousing & Logistics services

Advertising products from sellers that want better placement on its platform

Interest income on the loans that are extended

Other value-add services such as packaging and printing product labels or printing invoices.

Traction

As of March 2022, Udaan claimed to have over 1.7M retailers and over 25K sellers across 900+ cities in India. The company reported doing over 4.5M transactions each month. The company boasts a repeat purchase rate of over 94%.

In an article by Business Mavericks, Udaan’s revenue was reported to have increased from $6.69M in 2019 to $129.2M in 2020. This was a 21x surge within a year. Udaan’s revenue again increased by 6 times from $129.2M in 2020 to $808.7M in 2021.

Udaan’s annualized GMV was reported to be over $4B in July 2021, up from $3B in 2020. At the time Udaan was reported to have disbursed over $1B in loans, and over 200,000 businesses had utilized this credit.

Founder(s) & Team

Vaibhav Gupta: Co-founder and CEO at Udaan. Before setting up Udaan, Vaibhav worked with his co-founders at Flipkart as SVP of Finance and Analytics.

Amod Malviya: Co-founder and engineer at Udaan. Prior to Udaan, Amod was CTO at Flipkart.

Sujeet Kumar: Co-founder at Udaan. Before this venture, Sujeet was the President of Operations at Flipkart for 3 years.

History and Evolution

Prior to coming up with this idea of Udaan, all three co-founders were working together at Flipkart in executive roles. The company originally established itself as a logistics business, and for the first 10 months of operations catered to small customers or dealers working in electronics or apparel categories. After gaining popularity, the company formed its database of customers and dealers and began venturing into the delivery and lending business for merchants.

The company was reported to have onboarded over 180,000 buyers & sellers within the first 2 years of its operations. In September 2018, the company raised a round at a $1B valuation, becoming one of the fastest companies to become a Unicorn in India.

During the coronavirus pandemic, Udaan was severely impacted between April and November 2020. Several merchants on its platform shut down their businesses and Udaan was forced to lay off thousands of its contractual staff. However, in February 2021, the company claimed it had surpassed its losses in the peak covid period.

In September 2021, the company announced a decision to appoint founder Vaibhav Gupta as a CEO, after having run the company under a decentralized joint leadership of all 3 founders. The other co-founders meanwhile became board members.

There is speculation that Udaan may go for an IPO by 2023.

Additional Learnings

Udaan’s platform provides a number of additional offerings to sellers such as feedback analysis of real-time marketing. This helps sellers on the platform to make better-informed decisions to test their new products in different markets.

Udaan operates 11 subsidiaries that make up its different offerings such as its B2B marketplace, its logistics offering, its financing arm, and more.

The 2 categories that saw growth on Udaan’s platform even during the peak of the pandemic were food and pharmaceuticals.

Market Snapshot

Per an India Times report, Indian retail is a $1 trillion market of which 65% is made up of food & grocery. 96% of the market is unorganized and served by over 14 million kirana stores.

A typical Indian household was estimated to spend INR 10-12K (~$130-160) worth of food & grocery each month. Meanwhile, the average kirana store was estimated to purchase INR 600K (~$7.9K) worth of products.

B2B eCommerce players raised $2 Billion across 60 rounds in 2021.

In July 2021, online B2B commerce was less than 1% of the total retail market in India.

Suggested Next Reads

The Making of India’s Fastest Unicorn (YourStory Youtube, Aug ‘21)

Udaan’s revenue jumps 21X in FY20; losses surge to Rs 2,519 Cr (Entrackr, Feb ‘21)

Udaan back to pre-second wave levels with GMV of $4-5 billion (The Economic Times, July ‘21)

How Udaan Business Model is Making Revenue (Business Mavericks, Sept ‘21)

Behind the scenes: Why Udaan finally has a CEO (Money Control, Sept ’21)